I know, I know. Hindsight is 20-20, and here I am, the Monday morning armchair quarterback, making sense of what happened to the US banking system this past weekend.

Then again, my excuse is that I am no expert (not even close) so what is hindsight in my case should have been foresight on behalf of those who do this stuff for a living. The fact that it wasn’t…

How do banks work? Say, you deposit $100,000, and the bank pays you 2% interest. So far so good. But the bank doesn’t just sit on your money. If they did, they’d be losing money by paying you interest. No, they lend that money to me, say, in the form of a mortgage at 5% interest. The difference, that 3%, is the bank’s profit.

Suppose one day unexpectedly you show up and tell the bank that you want to withdraw your money. The bank doesn’t have $100,000 cash. Nor can they call on the money they lent to me, since it is in the form of a long-term mortgage. What they can do, however, is sell my mortgage to another lender. For me, that mortgage is debt; for the bank, it’s an asset, worth good money. So they sell it to another bank, get the $100,000 cash and now they can honor your request to withdraw your funds.

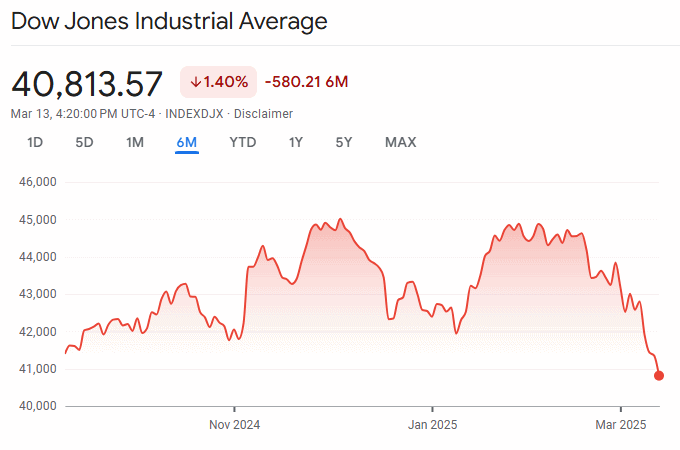

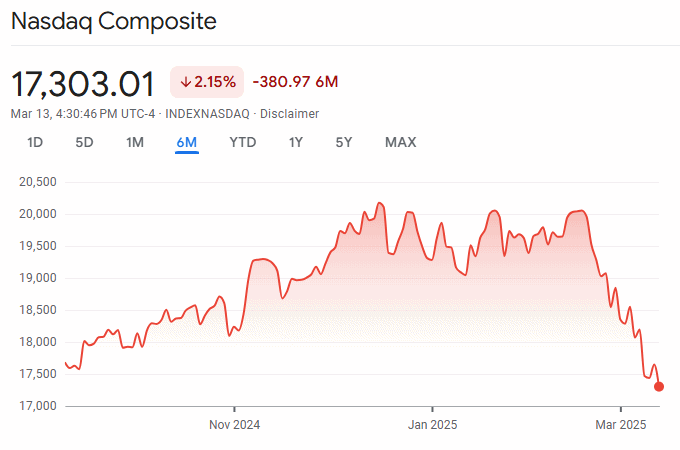

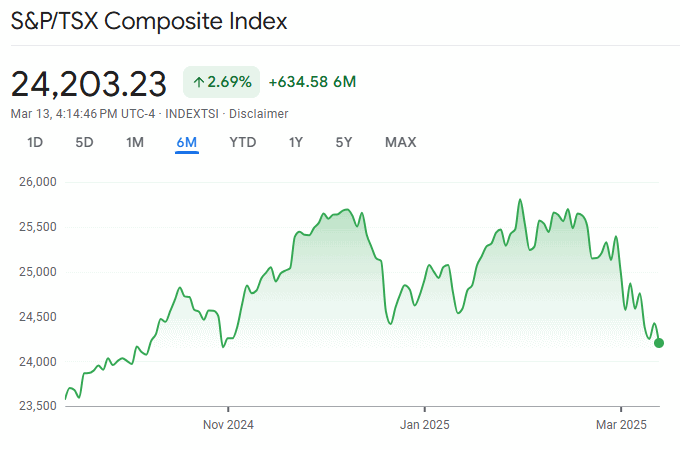

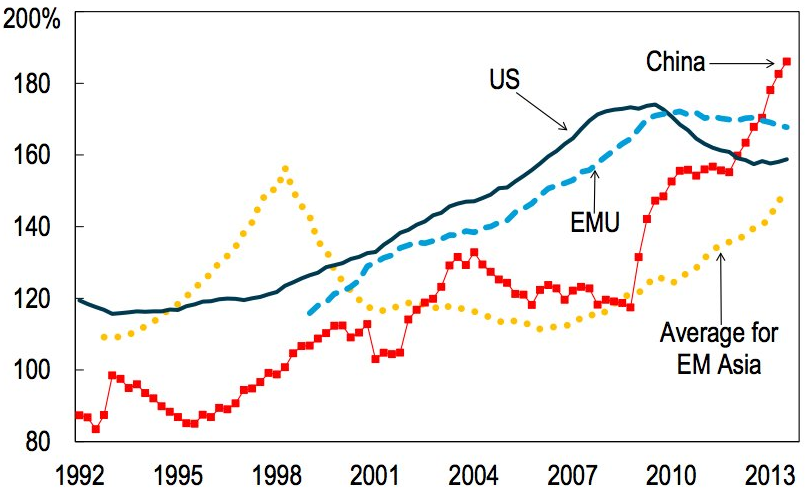

So far so good… but what happens if the county’s central bank raises interest rates rapidly? Say, in a short amount of time the central bank’s rate goes from a fraction of a percent to over 5%? When you come to our bank to withdraw your money, the bank tries to sell my 5% mortgage to another lender, but finds no buyers. Why would these other banks buy my 5% mortgage from our bank when they can invest their money in government bonds that have a 100% guarantee and now a yield better than 5%? Oops. You try to withdraw your money, but our bank is unable to oblige. When a bank cannot pay a depositor, it is big trouble. It basically means that the bank is going under.

When interest rates change slowly, gradually, this does not happen. Mortgages expire and need to be renewed at revised rates. The market adjusts. But when interest rates rise rapidly, the system cannot adjust. There is not enough time.

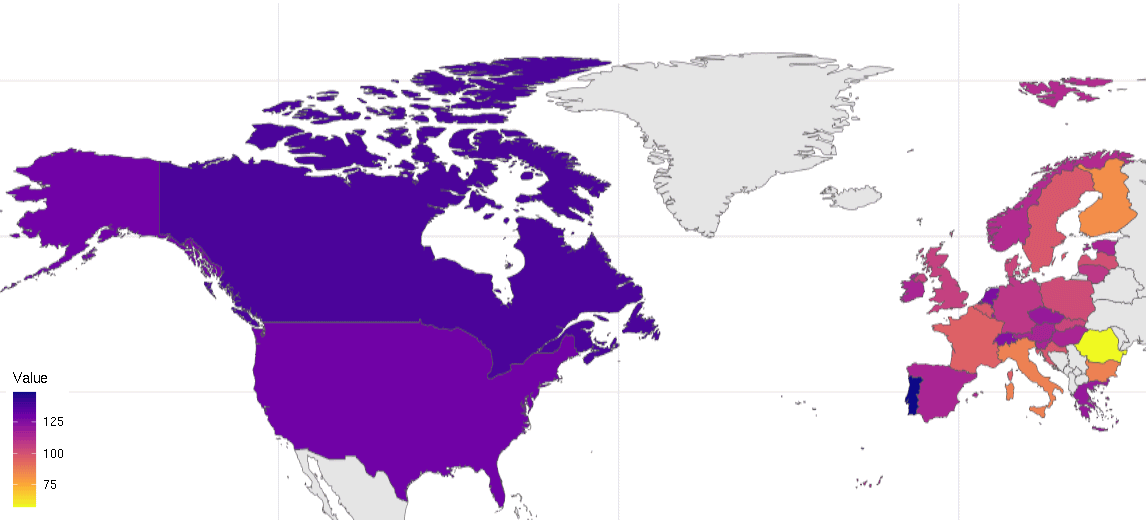

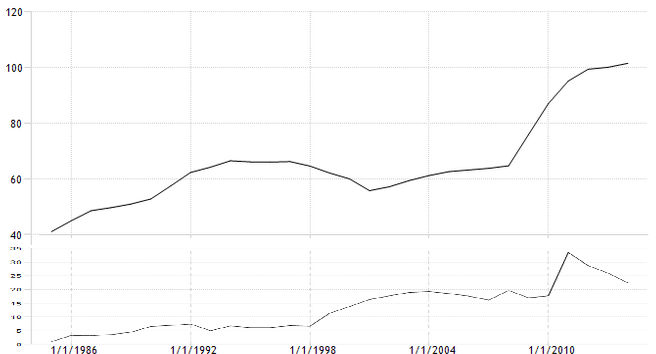

Central banks throughout the Western world have raised interest rates at a historically unprecedented pace in recent months, to fight inflation. Did they really not anticipate the consequences?

And now the reaction: some financial news sources suggest that, never mind further rate increases, the US Federal Reserve’s interest rate may actually come down next month. Now that worries me as it may be an overreaction. Overcompensating a controlled system can actually lead to even larger swings or oscillations.

What bothers me about this is that what I am describing here is not exactly ground-breaking revelation. Beyond the financial specifics, it is basic operations research, its modern roots dating back a century or so. Seriously, when they were raising interest rates as recklessly as they did, what were the central banks thinking? Were they truly not aware of these possible consequences? Or was fighting inflation so important that they opted to ignore the advice of their own knowledgeable experts?

When you have a family member who is gravely ill, you may not have the stamina to pay attention to other things. When you have a family pet that is gravely ill, it’s almost as bad (actually, in some ways it’s worse, as a pet cannot tell what hurts and you cannot explain to the pet why unpleasant medication is necessary or discuss with the pet the available treatment options.)

When you have a family member who is gravely ill, you may not have the stamina to pay attention to other things. When you have a family pet that is gravely ill, it’s almost as bad (actually, in some ways it’s worse, as a pet cannot tell what hurts and you cannot explain to the pet why unpleasant medication is necessary or discuss with the pet the available treatment options.)