Our cat Szürke is not only still with us, but his condition continues to improve. This is no small Christmas miracle. Made possible, well, by modern veterinary science and the money spent to pay for it, but also by the caring of veterinarians and their staff at Beechwood Animal Hospital (our “local” vet) and Alta Vista Animal Hospital (where Szürke received numerous transfusions and emergency care.)

Year after year, as Christmas Eve nears, I recall the Christmas message of Apollo 8 astronaut Frank Borman. Here is what he said in 1968, 45 years ago: “And from the crew of Apollo 8, we close with good night, good luck, a Merry Christmas and God bless all of you – all of you on the good Earth.”

Amen.

Damn it’s cold this morning. Negative 26 Centigrade. Or 27 if I believe the local news. And it’s not even winter yet!

Damn it’s cold this morning. Negative 26 Centigrade. Or 27 if I believe the local news. And it’s not even winter yet!

To be sure, I still prefer to live in the Great White North instead of any of the numerous southerly climates full of crazy people, but sometimes, it’s a bit too much. Like, when you feel like you need to put on a spacesuit just to step outside to grab your newspaper from your doorstep.

Yes, I still subscribe to a newspaper. Or rather, I again subscribe to a paper after canceling my Globe and Mail subscription more than a decade ago. I accepted their offer for a free three-month subscription back in the summer, and I became used to it. More importantly, I realized that there are things I’d never even read or hear about had they not been in the paper. Electronic media is great, but it tends to deliver the news that you actually want to hear. Especially as services like Google News or Facebook employ sophisticated algorithms that try to predict what you’re most likely to read based on your past behavior. So if you wish to step outside of your comfort zone, to have your views challenged, not simply confirmed… well, a newspaper helps.

Besides… as a last resort, you can also use a newspaper to start a fire to keep warm.

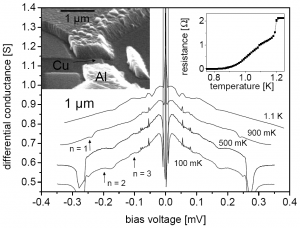

I am reading a very interesting paper by Christian Beck, recently published in Physical Review Letters.

Beck revives the proposal that at least some of the as yet unobserved dark matter in the universe may be in the form of axions. But he goes further: he suggests that a decade-old experiment with superconducting Josephson-junctions that indicated the presence of a small, unexplained signal may in fact have been a de facto measurement of the axion background in our local galactic neighborhood.

If true, Beck’s suggestion has profound significance: not only would dark matter be observable, but it can be observed with ease, using a tabletop experiment!

What is an axion? The Standard Model of particle physics (for a very good comprehensive review, I recommend The Standard Model: A Primer by Cliff Burgess and Guy Moore, Cambridge University Press, 2007) can be thought of as the most general theory based on the observed particle content in the universe. By “most general”, I mean specifically that the Standard Model can be written in the form of a Lagrangian density, and all the terms that can be present do, in fact, correspond to physically observable phenomena.

All terms except one, that is. The term, which formally reads

\begin{align}{\cal L}_\Theta=\Theta_3\frac{g_3^2}{64\pi^2}\epsilon^{\mu\nu\lambda\beta}G^\alpha_{\mu\nu}G_{\alpha\lambda\beta},\end{align}

where \(G\) represents gluon fields and \(g_3\) is the strong coupling constant (\(\epsilon^{\mu\nu\lambda\beta}\) is the fully antisymmetric Levi-Civita pseudotensor), does not correspond to any known physical process. This term would be meaningless in classical physics, on account of the fact that the coupling constant \(\Theta_3\) multiplies a total derivative. In QCD, however, the term still has physical significance. Moreover, the term actually violates charge-parity (CP) symmetry.

The fact that no such effects are observed implies that \(\Theta_3\) is either 0 or at least, very small. Now why would \(\Theta_3\) be very small? There is no natural explanation.

However, one can consider introducing a new scalar field into the theory, with specific properties. In particular this scalar field, which is called the axion and usually denoted by \(a\), causes \(\Theta_3\) to be replaced with \(\Theta_{3,{\rm eff}}=\Theta_3 + \left<a\right>/f_a\), where \(f_a\) is some energy scale. If the scalar field were massless, the theory would demand \(\left<a\right>/f_a\) to be exactly \(-\Theta_3\). However, if the scalar field is massive, a small residual value for \(\Theta_{3,{\rm eff}}\) remains.

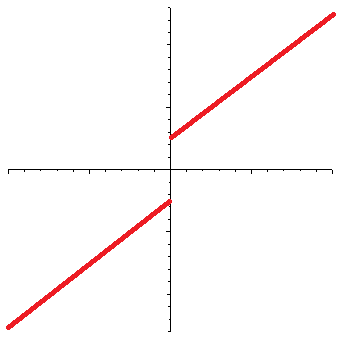

As for the Josephson-junction, it is a superconducting device in which two superconducting layers are separated by an isolation layer (which can be a normal conductor, a semiconductor, or even an insulator). As a voltage is introduced across a Josephson-junction, a current can be measured. The peculiar property of a Josephson-junction is the current does not vanish even as the voltage is reduced to zero:

(The horizontal axis is voltage, the vertical axis is the current. In a normal resistor, the current-voltage curve would be a straight line that goes through the origin.) This is the DC Josephson effect; a similar effect arises when an AC voltage is applied, but in that case, the curve is even more interesting, with a step function appearance.

The phase difference \(\delta\) between the superconductors a Josephson-junction is characterized by the equation

\begin{align}\ddot{\delta}+\frac{1}{RC}\dot{\delta}+\frac{2eI_c}{\hbar C}\sin\delta&=\frac{2e}{\hbar C}I,\end{align}

where \(R\) and \(C\) are the resistance and capacitance of the junction, \(I_c\) is the critical current that characterizes the junction, and \(I\) is the current. (Here, \(e\) is the electron’s charge and \(\hbar\) is the reduced Planck constant.)

Given an axion field, represented by \(\theta=a/f_a\), in the presence of strong electric (\({\bf E}\)) and magnetic (\({\bf B}\)) fields, the axion field satisfies the equation

\begin{align}\ddot{\theta}+\Gamma\dot{\theta}+\frac{m_a^2c^4}{\hbar^2}\sin\theta=-\frac{g_\lambda c^3e^2}{4\pi^2f_a^2}{\bf E}{\bf B},\end{align}

where \(\Gamma\) is a damping parameter and \(g_\lambda\) is a coupling constant, while \(m_a\) is the axion mass and of course \(c\) is the speed of light.

The formal similarity between these two equations is striking. Now Beck suggests that the similarity is more than formal: that in fact, under the right circumstances, the axion field and a Josephson-junction can form a coupled system, in which resonance effects might be observed. The reason Beck gives is that the axion field causes a small CP symmetry perturbation in the Josephson-junction, to which the junction reacts with a small response in \(\delta\).

Indeed, Beck claims that this effect was, in fact, observed already, in a 2004 experiment by Hoffman, et al., who attempted to measure the noise in a certain type of Josephson-junction. In their experiment, a small, persistent peak appeared at a voltage of approximately 0.055 mV:

If Beck is correct, this observation corresponds to an axion with a mass of 0.11 meV (that is to say, the electron is some five billion times heavier than this axion) and the local density of the axion field would be about one sixth the presumed dark matter density in this region of the Galaxy.

I don’t know if Beck is right or not, but unlike most other papers about purported dark matter discoveries, this one does not feel like clutching at straws. It passes the “smell test”. I’d be very disappointed if it proved to be true (I am not very much in favor of the dark matter proposal) but if it is true, I think it qualifies as a Nobel-worthy discovery. It is also eerily similar to the original discovery of the cosmic microwave background: it was first observed by physicists who were not at all interested in cosmology but instead, were just trying to build a low-noise microwave antenna.

Here is something new: America’s ever watchful National Security Agency is not content with spying in all the real lands of the world. Their interests also extend to imaginary realms, like the virtual world of Second Life and World of Warcraft.

Ostensibly, their concern is that terrorists around the world might be using online games for secret communication. The idea is not, in fact, new; for what it’s worth, a similar idea exists as a plot device in Margaret Atwood’s superb, dystopian Oryx and Crake trilogy.

So I guess I should count it as a blessing that other aspects of Atwood’s nightmarish future have not become reality yet. Instead of corporatist anarchy, all we have is a benevolent superstate ever more keen on enforcing Pax Americana. And who knows… our freedoms and privacy may be somewhat curtailed in this New World Order, but if the Roman example is any guide, it may be a small price to pay for centuries of stable prosperity.

Anyhow, for what it’s worth, as far as I know there is no spying going on in MUD1/British Legends and MUD2. I can actually vouch for MUD1 personally; I, after all, wrote the code for the current implementation.

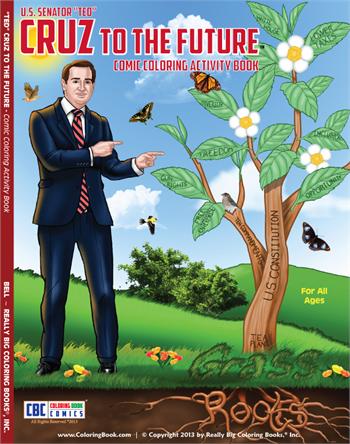

Imagine a country in which small children are given coloring books figuring a leading politician.

Imagine a country in which small children are given coloring books figuring a leading politician.

Coloring books that describe the politician in “non-partisan and fact-driven” terms. A lengthy speech becomes a “magnificent feat”, during which the dear leader spoke with “clairvoyant precision”. The goals of political opponents are “worse than any war”.

This coloring book is “approved by teachers and educators”. It is “designed to be a fun, educational tool”. Parents are encouraged to “Tell the truth – Tell it often – Tell the children”.

If you thought I was describing a North Korean coloring book featuring the “Great Successor” King Jong-un or his daddy or granddaddy, think again.

That is because the abomination that I just described was in fact published in the great United States of America. Its title: “Ted Cruz to the Future™ – Comic Coloring Activity Book“, published by Really Big Coloring Books®, Inc.

And it is available at Amazon for the bargain price of $5.69. Or it was, anyway; presently, it is shown as “Temporarily out of stock.”

Here are two kittycats, Kifli (left) and Szürke. Szürke is the cat who caused us many a sleepless night in the past two months, with his mysterious anaemia.

The good news is that he is holding steady, now nearly three weeks since his last transfusion. His red blood cell count is still not recovering the way it should, but we may have arrested the loss. My fingers remain firmly crossed.

Hard to believe but back in his heyday, Szürke was significantly heavier than his brother.

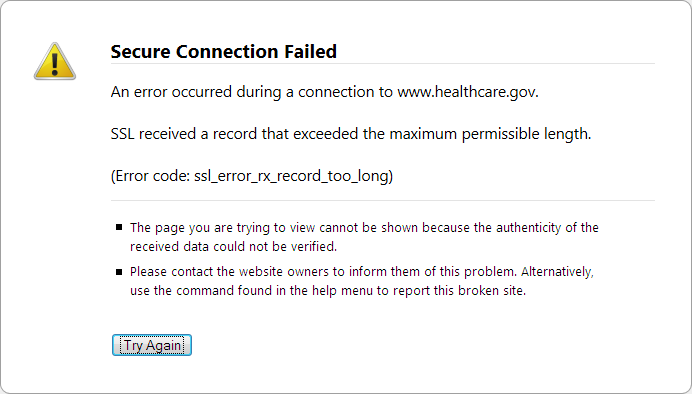

American news channels are abuzz with news about the revamped Obamacare Web site, healthcare.gov.

Moments ago, out of curiosity, I visited the site. To be precise, I wanted to search for news about healthcare.gov, so clicking on a link that actually took me to the site is something I did more by accident than by design.

Indeed, I only realized that I actually visited the site (and not just a news site page about the site) when I encountered the following error:

Ah, the irony.

It’s only November, for crying out loud, but winter has arrived with a vengeance.

It’s only November, for crying out loud, but winter has arrived with a vengeance.

Yesterday, the temperature was -21 centigrade (at least according to Microsoft; on the Weather Channel, it was “only” -18 I believe.)

Today, we are enjoying a balmy -12.

And winter is officially still more than three weeks away.

Brrrr.

While responding to a question on ResearchGate, I thought about black holes and event horizons.

When you study general relativity, you learn that a star that is dense enough and massive enough will undergo gravitational collapse. The result will be a black hole, an object from which nothing, not even light, can escape. A black hole is surrounded by a spherical surface, its event horizon. It is not a physical surface, but a region that is characterized by the fact that the geometric distortions of spacetime due to gravity become extreme here. Once you cross the horizon, there is no turning back. It acts as a one-way membrane. Anything inside will unavoidably fall into the so-called singularity at the center of the black hole. What actually happens there, no-one really knows; gravity becomes so strong that quantum effects cannot be ignored, but since we don’t have a working quantum theory of gravity, we can’t really tell what happens.

That said, when you study general relativity, you also learn that a distant observer (such as you) can never see the horizon form. The horizon will forever remain in the distant observer’s infinite future. Similarly, we never see an object (or even a ray of light) cross the horizon. For a distant observer, any information coming from that infalling object (or ray of light) will become dramatically redshifted, so much so that the object will appear to crawl to a halt, essentially remaining frozen near the horizon. But you won’t actually get a chance to see even that; that’s because due to the redshift, rays of light from the object will become ever longer wavelength radio waves, until they become unobservable. So why do we bother even thinking about something that provably never happens in a finite amount of time?

For one thing, we know that even though a distant observer cannot see a horizon form, an infalling observer can. So purely as a speculative exercise, we would like to know what this infalling observer might experience.

And then there is the surface of last influence. We may not see an object cross the horizon, but there is a point in time beyond which we can no longer influence an infalling object. That is because any influence from us, even a beam of light, will not reach the object before the object crosses the horizon.

This is best illustrated in a so-called Penrose diagram (named after mathematician Roger Penrose, but also known as a conformal spacetime diagram.) In this diagram, spacetime is represented using only two dimensions on a sheet of paper; two spatial dimensions are suppressed. Furthermore, the remaining two dimensions are grossly distorted, so much so that even the “point at infinity” is drawn at a finite distance from the origin. However, the distortion is not random; it is done in such a way that light rays are always represented by 45° lines. (Such angle-preserving transformations are called “conformal”; hence the name.)

So here is the conformal spacetime diagram for a black hole, showing also an infalling object and a distant observer trying to communicate with this object:

Time, in this diagram, passes from bottom to top. The world line of an object is a (not necessary straight) line that also moves from bottom to top, and is never more then 45° away from the vertical (as that would represent faster-than-light motion).

In this diagram, a piece of infalling matter crosses the horizon. It is clear from the diagram that once that happens, there is nothing that can be done to avoid hitting the singularity near the top of the diagram. To escape, the object would need to move faster than light, in order to cross, from the inside to the outside, the 45° line representing the horizon.

An observer traveling along with the infalling object can bounce, e.g., radar waves off that object. However, that cannot go on forever. Once the observer’s world line crosses the line drawn to represent the surface of last influence, his radar waves will no longer reach the infalling object outside the horizon. Any echo from the object, therefore, will not be seen outside the horizon; it will remain within the horizon and eventually be swallowed by the singularity.

So does the existence of this surface of last influence mean that the event horizon exists for real, even though we cannot see it? This was an argument made in the famous textbook on relativity, Gravitation by Misner, Thorne and Wheeler. However, I tend to disagree. Sure, once you cross the surface of last influence, you can no longer influence an infalling object. Nonetheless, you still won’t see the object actually cross the horizon. Moreover, if the object happens to be, say, a very powerful rocket, its pilot may still change his mind and turn around, eventually re-emerging from the vicinity of the black hole. The surface of last influence remains purely hypothetical in this case; it is defined by the intersection of the infalling object and the event horizon, something that never actually happens.

When you have a family member who is gravely ill, you may not have the stamina to pay attention to other things. When you have a family pet that is gravely ill, it’s almost as bad (actually, in some ways it’s worse, as a pet cannot tell what hurts and you cannot explain to the pet why unpleasant medication is necessary or discuss with the pet the available treatment options.)

When you have a family member who is gravely ill, you may not have the stamina to pay attention to other things. When you have a family pet that is gravely ill, it’s almost as bad (actually, in some ways it’s worse, as a pet cannot tell what hurts and you cannot explain to the pet why unpleasant medication is necessary or discuss with the pet the available treatment options.)

As I’ve been dealing with a gravely ill cat in the past six weeks, I neglected to pay attention to other things.

I did not add a blog entry on October 31 with my drawing of a Halloween cat.

I did not comment on Remembrance Day. I am very fond of Remembrance Day, because it does not celebrate victory nor does it glorify war; on the contrary, it celebrates sacrifice and laments on the futility of war. This is why I am so unimpressed by the somewhat militantly pacifist “white poppy” campaign; in my view, they completely miss the point. I usually put a stylized poppy in my blog on November 11; not this year, as I spent instead a good portion of that day and the next at the vet.

I most certainly did not comment on that furious (and infuriating) wild hog of a mayor, Toronto’s Rob Ford, or for that matter, the other juicy Canadian political scandal, the Senate expense thing. That despite the fact that for a few days, Canadian news channels were actually exciting to watch (a much welcome distraction in my case), as breaking news from Ottawa was interrupted by breaking news from Toronto or vice versa.

I also did not blog about the continuing shenanigans of Hungary’s political elite, nor the fact that an 80-year old Hungarian writer, Akos Kertesz (not related to Imre Kertesz, the Nobel-laureate) sought, and received, political asylum, having fled Hungary when he became the target of threats and abuse after publishing an article in which he accused Hungarians of being genetically predisposed to subservience.

Nor did I express my concern about the stock market’s recent meteoric rise (the Dow Jones index just hit 16,000) and whether or not it is a bubble waiting to be burst.

And I made no comments about the horrendous typhoon that hit the Philippines, nor did I wonder aloud what Verizon Canada must be thinking these days about their decision to move both their billing and their technical support to that distant country.

Last but certainly not least, I did not write about the physics I am trying to do in my spare time, including my attempts to understand better what it takes for a viable modified gravity theory to agree with laboratory experiments, precision solar system observations, galactic astronomy and cosmological data sets using the same set of assumptions and parameters.

Unfortunately, our cat remains gravely ill. The only good news, if it can be called that, is that yesterday morning, he vomited a little liquid and it was very obviously pink; this strongly suggests that we now know the cause of his anaemia, namely gastrointestinal bleeding. We still don’t know the cause, but now he can get more targeted medication. My fingers remain crossed that his condition is treatable.

Our cat Szürke remains gravely ill and I don’t know if he will make it.

Our cat Szürke remains gravely ill and I don’t know if he will make it.

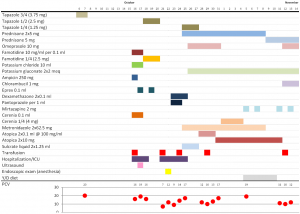

About two years ago, he was diagnosed with hyperthyroidism, a not altogether uncommon disease among older cats. At the time, we opted to treat his condition with medication (Tapazole); the alternative would have been radiological treatment, which works well but would have required him to spend a long time (couple of weeks, we were told at the time) in quarantine.

Szürke has been doing well although lately, he has been losing weight.

Then, on Sunday October 6, he started vomiting. Occasionally throwing up a furball is not exactly a problem with most cats. Vomiting a clear, foamy liquid eight times in an hour is.

The next day, we took Szürke to our local vet who diagnosed him with renal failure, noted that he was dehydrated, and his T4 level was also very low. We discontinued the Tapazole. Even more alarmingly, he was becoming a little anaemic, with a PCV level of 20 (normal, I believe, is between 30 and 50).

We brought Szürke home. He was doing okay, though his appetite was not great. A week later, on October 16, we went back to the vet for a recheck. The vet became very alarmed when Szürke’s PCV level was measured at 15. She immediately recommended that we take him to Alta Vista Animal Hospital, where he would get a transfusion.

Szürke spent two days at Alta Vista. When we brought him home, the diagnosis was still largely unchanged: the anaemia was believed to have been caused by advanced renal failure. The only thing odd was that his renal values were really not that bad. On the other hand, an ultrasound examination showed no other abnormalities that could have been responsible for his condition.

We brought Szürke home on Friday, October 18, with a prescription for Eprex, a subcutaneous injection that was supposed to stimulate his bone marrow and help him produce red blood cells. Szürke got his first injection on Saturday, but we never got to the second two days later, as by that time, Szürke stopped eating altogether. So instead of injecting him, I took him back to Alta Vista.

This time around, Szürke spent four days at the hospital. He received two more transfusions, as his PCV levels dropped to alarmingly low levels (the lowest, I believe, was 7.) On Tuesday, October 22, we actually visited him late at night, thinking that this was probably good-bye.

By this time, however, the diagnosis was different. For starters, a detailed blood test showed that his anaemia is likely regenerative: his reticulocyte count was higher than normal, in fact. I actually viewed this as both a ray of hope and as a message of sorts: if his little body has not yet given up fighting, how can I give up on him?

So the question then, was this: is his regenerative anaemia anemia due to a haemorrhage or haemolysis?

There were no obvious signs of haemorrhage. There was no blood in his vomit or his stool (though my wife and I noticed, and brought to the vet’s attention, that his stools were significantly darker than normal.) So the doctor’s first bet was that the anaemia is haemolytic, due either to an infection or an autoimmune condition. A biopsy was non-conclusive but it indicated a possible minor gastrointestinal infection. Still, the doctors were leaning towards an autoimmune condition as a more likely explanation.

I brought Szürke home on the 25th of October, with prescriptions for Prednisone, Omeprazole, potassium gluconate, Metronidazole and Sulcrate. He was also back on Tapazole, albeit at a much reduced dose. His PCV level after his last transfusion was 17. Yet three days later, when I took him back for a recheck appointment, his PCV was down to 12. At this time, after discussions with the doctor, we opted to discontinue to the Tapazole altogether, betting on the possibility that the autoimmune response was due to sensitivity to this medication. The Sulcrate was also discontinued (he responded very badly to my attempts to administer this liquid medication.) On the other hand, he began receiving cyclosporine in liquid form.

Nonetheless the next day, his PCV levels were further down, to 10, and he was vomiting, so I took him back to Alta Vista for his fourth transfusion. With his PCV back at 13, I brought him home. Two days later, on October 31, we went for a recheck and, surprise: his PCV was up to 17! Finally, some real hope, we thought. Also at this time, the liquid cyclosporin was discontinued in favor of a capsule, which was much easier to administer.

We were okay for a few days. The next visit was on Friday, November 4. By then, Szürke’s PCV was up to 20! However, his T4 levels were going through the roof, due to his untreated thyroid condition. On the vet’s advice, we began to give him an appetite stimulant (Mirtazapine) in the hope that this will be sufficient to make him eat a special, low-iodine diet (Hill’s Y/D) which would allow us to control his thyroid without medication.

For a few days, all seemed to go well but then his appetite dropped, despite the Mirtazapine. On November 11, I took Szürke to our local vet, who checked his PCV: a disastrous 11. I immediately discontinued the Y/D diet and started giving him whatever he liked… the thinking was that if these were to be his last few days on Earth, I won’t try to starve him with food he wouldn’t eat, and if there is still hope, the thyorid is a long-term concern, whereas the anaemia can kill him in days.

The next day, I discussed all this with the vet at Alta Vista who suggested another possible treatment: Chlorambucil (medication so dangerous, I’m advised to wear rubber gloves when handling the capsules. Scary.) The vet also reluctantly recommend another transfusion. By the time we got to Alta Vista, Szürke’s PCV was down to 9. When I brought him home very late at night, it was back to 12 as a result of the transfusion.

That was two days ago. Szürke is home today, and seemingly doing well. But that has always been the case; even when he was weak as a kitten, his happy disposition never changed, he never ceased being playful, never even stopped grooming himself.

He is eating moderately well. He is interested in the world around him. He is still accepting his medications without too much trouble.

But we still don’t really know what on Earth is wrong with him in the first place. So we are left with taking things one day at a time. I have no idea what tomorrow will bring.

I have been collaborating with John Moffat on his modified gravity theory and other topics since 2007. It has been an immensely rewarding experience.

I have been collaborating with John Moffat on his modified gravity theory and other topics since 2007. It has been an immensely rewarding experience.

John is a theoretical physicist who has been active for sixty years. During his amazingly long career, John met just about every one of the iconic figures of 20th century physics. He visited Erwin Schrödinger in a house where Schrödinger lived with his wife and his mistress. He was mentored by Niels Bohr. He studied under Fred Hoyle (the astronomer who coined the term “Big Bang”). He worked under Paul Dirac. He shared office space with Peter Higgs. He took Wolfgang Pauli out for a wet lunch on university funds. He met Feynman, Oppenheimer, and many others. The one iconic physicist Moffat did not meet in person was Albert Einstein; however, Einstein still played a pivotal role in his career, answering letters written to him by a young John Moffat (then earning money as a struggling artist) encouraging him to continue his studies of physics.

Though retired, John remains active as a member of the prestigious Perimeter Institute in Waterloo. I don’t expect him to run out of maverick ideas anytime soon. Rare among physicists his age, John’s knowledge of the science is completely up-to-date, as is his knowledge of the tools of the trade. I’ve seen physicists 20 years his junior struggling with hand-written transparencies (remember those, and the unwieldy projectors?) even as John was putting the finishing touches to his latest PowerPoint presentation on his brand new laptop or making corrections to a LaTeX manuscript.

More recently, John began to write for a broader audience. He already published two excellent books. His first, Reinventing Gravity, describes John’s struggle to create a viable alternative to Einstein’s General Theory of Relativity, a new gravity theory that would explain mysteries such as the rotation of galaxies without resorting to the dark matter hypothesis. John’s second book, Einstein Wrote Back, is a personal memoir, detailing his amazing life as a physicist.

John’s third book, which is about to be published, is perhaps his most ambitious book project yet. Cracking the Particle Code, published by the prestigious Oxford University Press, is about the decades of research in particle physics that resulted in the recent discovery of what is believed to be the elusive Higgs boson, and John’s attempts to explore theoretical alternatives that might make the Higgs boson hypothesis unnecessary, and provide alternative explanations for the particle observed by the Large Hadron Collider.

I had the good fortune of being able to read the manuscript earlier this year. My first reaction was that John took up an almost impossible task. As many notable physicists, including Einstein, observed, quantum physics is harder, perhaps much harder, than relativity theory. The modern Standard Model of particle physics combines the often arcane rules of quantum field theory with a venerable zoo of particles (12 fermions and their respective antiparticles, four vector bosons, eight gluons and, last but not least, the Higgs boson). Though the theory is immensely successful, it is unsatisfying in many ways, not the least because it fails to account for perhaps the most fundamental interaction of all: gravity. And its predictions, while exact, are very difficult to comprehend even for trained theorists. Reducing data on billions of collisions in a large accelerator to definitive statements about, say, the spin and parity of a newly observed particle is a daunting challenge.

Explaining all this in a form that is accessible to the interested but non-professional reader is the task that John set out to tackle. His text mixes a personal narrative with scientific explanations of these difficult topics. To be sure, the technical part of the text is not an easy read. This is not John’s fault; the topic is very difficult to understand unless you are willing to invest the time and effort to study the mathematics. But John’s personal insights perhaps make the book enjoyable even to those who choose to skip over the more technical paragraphs.

There are two points in particular that I’d like to mention in praise. First, John’s book is amazingly up-to-date; as late as a few weeks ago, John was still making small corrections during the copy editing process to ensure that everything he says is consistent with the latest results from CERN. Second, John’s narrative always makes a clear distinction between standard physics (i.e., the “consensus”) and his own notions. While John is clearly passionate about his ideas, he never forgets the old adage attributed to the late US Senator, Daniel Patrick Moynihan: John knows that he is only entitled to his own opinions, he is not entitled to his own facts, and this is true even if the facts invalidate a theoretical proposal.

I hope John’s latest book sells well. I hope others will enjoy it as much as I did. I certainly recommend it wholeheartedly.

Here is a new statistic.

Here is a new statistic.

In the first seven months of 2013, there were 25 reports of verbal or physical insults against Muslims on the streets of Quebec’s cities.

Then, the Parti Quebecois government introduced the notion of its “value charter”, aimed at banning the wear of religious clothing and overtly religious symbols by people employed in the public service.

In the past month, there were 117 instances of verbal or physical abuse reported by Muslims (in the overwhelming majority of cases, by Muslim women) who were insulted on Quebec streets.

In other words, Quebec nationalists, under the guise of protecting women’s rights, created a problem where none existed, and pitted communities against each other.

I am sick to the stomach by nationalism be it Hungarians, Jews, Russians, Chinese, or for that matter, Quebecois.

The other day, I bought a fine jar of “No Name” brand Polish pickles at Loblaws. They were great pickles. Nothing wrong with the quality or the taste.

However, there was something my wife noticed on the label that was, shall we say, surprising.

Can’t see it? Here are the relevant bits, enlarged:

Still, I may stick to the same brand. Not only are the pickles really tasty, but Canada, after all, does export plenty of food to India, including lentils. So it’s only fair for us to eat some Indian-made Polish pickles in return. Especially since they really are yummy.

I just spent a small

Fortune at the vet,

And all I got to bring home

Is this lousy cat.

Our cat Szürke’s packed cell volume (PCV) is up this morning. A ray of hope. Dare we hope? Or is it just that roller coaster thing again, and his PCV might come crashing down over the weekend, as it did before? If that happens, we’re really out of options.

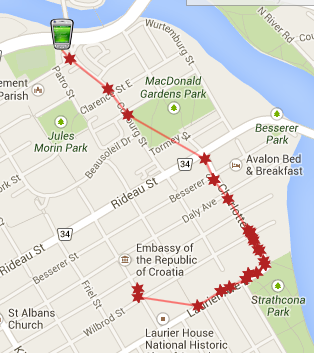

My wife took the #7 bus yesterday on her way home from the Byward Market.

The bus had to take a detour, due to the ongoing construction on Rideau street.

Then it had to take a further detour, perhaps due to the construction, maybe some other reason (an accident?)

When I spoke to her, the bus was standing still on Chapel street, heading in the wrong direction.

Some 20 minutes later, when the bus was already on Laurier, I turned on continuous GPS tracking of her phone. Tracking information was collected roughly every minute.

All in all, it took her approximately 45 minutes to get home from the intersection of Chapel and Wilbrod streets.

According to Google Maps, the distance is 950 meters on foot, and it would have take 12 minutes to get home walking. Unfortunately, she had some heavy bags with her so walking was not really an option. Although, had she known what was about to happen, she could have gotten off the bus at Besserer and Chapel, only a 700 meter walk from home.

Construction season is so much fun.

Our second oldest cat, Szürke (his name means gray in Hungarian, as he is a gray tabby; but we often just call him Süsü, which means something like silly, because he’s a silly little lapcat), is gravely ill. (As is my bank account as a result of the veterinary expenses, but that is another story.)

Trouble is, we don’t know what’s wrong with him.

He has hyperthyroidism, that much we know; he has been getting medication for that for a couple of years already.

But most recently, he became severely anemic. The doctors at first suspected renal failure. But that does not seem to be the case. The problem is more acute, perhaps some gastrointestinal bleeding. Yet still, there is no obvious cause, hence no obvious treatment.

His red cell count keeps dropping. We visited him tonight in the veterinary hospital. We are prepared for the possibility that this was good-bye.

But we have not yet given up hope.

Four years ago, the Nobel peace prize was awarded to Barack Obama, despite the fact that he was still at the beginning of his presidency and it was not at all clear yet what his legacy would be with respect to world peace. Some accused the Nobel committee of political activism.

Four years ago, the Nobel peace prize was awarded to Barack Obama, despite the fact that he was still at the beginning of his presidency and it was not at all clear yet what his legacy would be with respect to world peace. Some accused the Nobel committee of political activism.

Last year, the prize was awarded to the European Union. Many were appalled that a faceless organization received the prize, but at least arguably, this organization is indeed responsible for lasting peace among nations that were once bitter enemies and fought each other in two world wars.

But now, they awarded the prize to the Organization for the Prohibition of Chemical Weapons. Another faceless organization, whose efforts have yet to bear fruit in Syria.

I do not mean to belittle the efforts of the OPCW, but why did they not award the prize to an actual person, namely Malala Yousafzai? With her fight for girls’ education, and her exceptionally forgiving attitude towards those who tried to murder her, she is the embodiment of what fighting for a peaceful world really means: courage and grace, and wisdom well beyond her years.

I hope she’ll get another chance next year.

Reader’s Digest recently conducted an interesting experiment: they “lost” 12 wallets, filled with about $50 worth of cash and sufficient documentation to locate the owner, in 16 cities around the world. The result: Finns in Helsinki are the most honest with 11 of the 12 wallets returned, whereas in Lisbon, Portugal, the sole wallet that was returned was, in fact, found by a visiting Dutch couple. Finns needless to say, are rejoicing: “we don’t even run red lights,” boasted a Helsinki resident.

Reader’s Digest recently conducted an interesting experiment: they “lost” 12 wallets, filled with about $50 worth of cash and sufficient documentation to locate the owner, in 16 cities around the world. The result: Finns in Helsinki are the most honest with 11 of the 12 wallets returned, whereas in Lisbon, Portugal, the sole wallet that was returned was, in fact, found by a visiting Dutch couple. Finns needless to say, are rejoicing: “we don’t even run red lights,” boasted a Helsinki resident.

So what can we conclude from this interesting experiment? Perhaps shockingly, almost nothing.

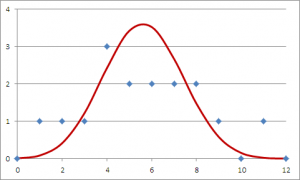

This becomes evident if I plot a histogram with the number of wallets returned, and overlay on it a binomial distribution for a probability of 46.875% (which corresponds to the total number of wallets returned, 90 out of 192), I get a curve that is matched very closely by the histogram. Unsurprisingly, there will be a certain probability that in a given city, 1, 2, 3, etc. wallets are returned; and the results of Reader’s Digest match this prediction closely.

So there is no reason for Finns to rejoice or for the Portuguese to feel shame. It’s all just blind luck, after all. And the only valid conclusion we can draw from this experiment is that people are just as likely to be decent folks in Lisbon as in Helsinki.

But how do you explain this to a lay audience? More importantly, how do you prevent a political demagogue from drawing false or unwarranted conclusions from the data?