Recently, I needed a bit of cash and I decided to take advantage of one of those “0% interest” loan offers that regularly appears in my mailbox for several of my credit cards. It was very easy to do of course, all I had to do was to deposit a check in my bank account.

Recently, I needed a bit of cash and I decided to take advantage of one of those “0% interest” loan offers that regularly appears in my mailbox for several of my credit cards. It was very easy to do of course, all I had to do was to deposit a check in my bank account.

But when the credit card statement arrived next month, I was in for a surprise. True, the loan was at 0% interest, just as advertised. However, what I neglected to take into account was that this credit card actually had an insurance contract attached to it. I never kept a balance on this card, so whether or not it had insurance was completely irrelevant to me… until now, when I suddenly noticed that my supposedly 0% interest loan suddenly increased by a full 1% in just a month! (Actually, 1.08% to be precise, because the insurance was also subject to provincial sales tax.)

Needless to say, I called up the bank and immediately canceled this ridiculous insurance, cursing myself for not having done this sooner. (Live and learn.) Another month went by and a new bill arrived. Behold! That 1% of the original loan amount that they added in the form of insurance qualified as a “purchase”, with interest calculated at the standard (albeit rather usurious) rate of 17.99%. And of course you cannot pay off just this amount; any payment you make to the card will be distributed by this particular bank proportionately between the lower and higher interest rate amounts that you owe, so 99% of the payment I made went against the 0% interest original loan amount.

My cash crunch was long over, so I phoned the bank and simply told them that unless they are willing to rectify this situation, I am going to pay of this card immediately and close the account. To their credit, they rectified the problem right away (or so they said; it’s not yet reflected when I check the account over the Internet, but hopefully all will be well when next month’s bill arrives.)

But it got me thinking: how does this scam (for I do not really have a better word for it) work when it involves people less attentive to numbers than I?

So let’s say you start with a $5,000 loan that you take out at the promised 0% interest for, let’s say, 12 months. You naively expect that if you keep paying the minimum payment (1% each month) then by the end of the 12 months, you will have payed off $568.08, with $4,431.92 still owing. Well… not exactly.

What actually happens is that you will have paid a total of $602.64 at the minimum rate. Yet your final balance at the end of the year is $5,094.40, so you now owe $94.40 more than you originally borrowed. In the intervening twelve months, the bank will have charged you $602.52 in credit insurance; $48.14 in sales tax (at the Ontario provincial rate of 8%); and a further $47.99 in interest on these “purchases”.

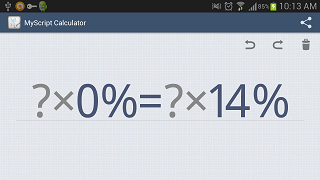

Lumping it all together, it amounts to an effective interest rate of 14% that you ended up paying on a loan that was advertised at a 0% interest rate.

And this if you did not use your card for anything else. Remember, when you make a payment, this particular bank (and probably, many/most others) applies your payment proportionately to the lower and higher interest rate portions of the total amount you owe. So you cannot just pay off your high interest purchases at the end of the month; they will keep on accruing interest so long as your 0% interest loan remains on your account.

At times like this, I regret not being religious. Otherwise, I could believe as Dante that usurers get what they deserve in the afterlife:

“There where thou sayest usury gives offence

“To goodness infinite and the knot untie.”

“Philosophy,” he said, “th’ observant mind,

“Teaches this truth, not in one place alone,

“That Nature takes her method and her course

“From the divinte intelligence and art;

“And if thy physics thou hast studied well,

“Then thou before thou readest far shalt find

“That this thy art, so far as it hath pow’r

“Follows as pupil in his master’s steps;

“So of God’s child thine art seems almost child.

“From these two, then, if thou in mem’ry hold’st

“The earlier Genesis, it is decreed

“That life must spring, and man’s increase must come.

“But then the usurer treads another path;

“Nature and her attendant both he scorns,

“Since in another means he places hope.”