There is an interesting article in The Globe and Mail this morning that asks a very curious question: given the amounts of money spent in Canada to help save GM and Chrysler (who do most of their research and engineering outside of Canada), why was there not a similar government effort to save Nortel from bankruptcy, even though this company was by far Canada’s largest contributor to private research?

The EU banned the import of Canadian seal products, in an attempt to stop the cruel practice of seal hunting.

About bleeping time, I say. We can thank Brussels for making a decision that our own spineless politicians were unwilling to make.

Yes, it means the loss of income for some who made a (part-time) living from hunting seals. I am not against them but what can I say? Should we also reinstate the death penalty just so that we don’t end up with unemployed executioners?

There is also a concern that stopping the seal hunt would threaten already depleted fish stocks, as seals that would otherwise be hunted will eat millions of tons of fish. Inflated numbers aside, there may be some truth in that… but again, chances are humans eat a lot more fish than seals do, so if we’re really concerned about the future of fish stocks, perhaps it’s time to fish a little less and not treat the oceans as an undepletable source.

Now if only our politicians were smart enough to move on and not spend millions of taxpayer dollars (more than the entire industry is worth) to fight this eminently reasonable and humane European decision… Those millions would be much better spent on the battle to block American efforts to export a Draconian copyright law to our country, a fight in which the latest round was fired recently when the Obama government put Canada on the same blacklist of copyright violators that contains Russia and China. All because we’re unwilling to give Mickey Mouse a 99 year copyright and put kids on jail for sharing music online.

Jack Kemp has died. He was a former American Congressman and vice presidential candidate, also a champion of the theory of supply side economics.

The basic premise of supply side economics is that lowering taxes increases demand; increased demand means a healthier economy, hence more tax revenue.

Others say hogwash, supply side economics is just a euphamism for making the rich richer at the expense of the public treasury, i.e., ultimately at the expense of the poor.

So which side is right? Neither.

Or, to be more precise, neither side is right all the time, though both have a point. Yet both are liars, since both elevate to the level of universal truth a principle that is right only some of the time.

Let me illustrate. If the average rate of taxation is 0%, there is obviously no government revenue. If the rate of taxation is 100%, i.e., the State takes away everything, there is no economy, hence no government revenue. At intermediate values, i.e., when the taxation rate is somewhere between 0% and 100%, there is some government revenue. One of the simplest curves that satisfy these criteria looks like this:

Revenue vs. taxation rate

In reality, the curve may be more complicated, but it’s going to be continuous and it’s going to be positive between the end points, hence it will have (at least one) maximum. And here’s the kink. The supply siders are right if the current rate of taxation happens to be to the right of that maximum… lowering the tax rate would indeed increase economic activity and hence, government revenue. But if the present taxation rate is to the left of the maximum, decreasing the tax rate will decrease revenue, and while it may increase economic activity, it certainly also increases the public debt.

So the trick, for a responsible but cash-strapped government, would be to find the maximum of this curve not to subscribe to any political ideology. Not that it’s likely to happen… politicians need snappy soundbytes to secure victory, not boring explanations.

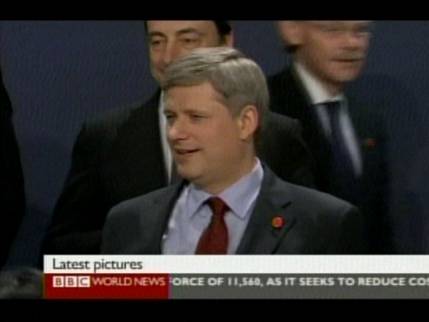

They did a group photo at the G-20 and our very own Prime Minister, Stephen Harper, was missing. According to a Canadian television channel, he was busy engaged in a discussion with an official. According to the BBC, he was in the toilet.

Stephen Harper

So they redid the group photo. Or tried to, anyhow. This time around, Berlusconi appeared to be missing… there was no word why.

Nonetheless, signs are that the G-20 meeting was (at the very least) not a failure, and perhaps even a modest success. I guess we’ll know in the next couple of days. But, if it is not just wishful thinking and real, meaningful decisions were made, then perhaps this is where the world changes to a track different from the one followed in the 1930s… instead of choosing protectionism, leading to a collapse of international trade, we’re choosing to keep the system of international trade robust and intact.

The BBC just updated their story: quoting a Harper press secretary, they’re now saying that Harper was indeed engaged in a conversation with an aide, he was not in the washroom.

I’m hearing on the BBC that Japan’s exports in February are down 50% since February last year and that their car exports are down an astonishing 70%.

These numbers are insane. What is this world coming to?

Republican lawmakers in America are concerned: they think that the request of the Obama administration and its treasury secretary for additional powers represents an unprecedented power grab. Being a libertarian at heart, I share their concerns even as I recognize the necessity for unprecedented government intervention at a time of unprecedented crisis.

But, it is difficult not to notice of the hipocrisy. The same lawmakers did not appear to be nearly as upset when the Bush administration grabbed unprecedented powers… not in the economic arena, mind you, but in the area of safety and security, directly impacting the personal freedoms and liberties of not just Americans, but also foreign nationals on American soil, such as Canadian Maher Arar who was deported to Syria for torture and unlawful imprisonment. If only Republican lawmakers were as eager to guard constitutional freedoms back then!

This phony, populist outrage over the AIG bonuses is really becoming ridiculous. They make it sound as if AIG’s top executives just took the bailout money as bonuses and ran with it. But that’s nonsense. First of all, the bonuses in question amount to barely 0.1% of the bailout that AIG received. Second, there are managers and there are managers… the ones getting these bonuses, are they the top level managers responsible for AIG’s demise, or are they the managers running, say, a successful branch office of AIG insurance?

Of course answering these questions might require some investigative journalism, some thinking, some hard explaining… not the kind of stuff the soundbyte journalism of the cable news universe likes. Glad I am not going to be home tonight, as I will not even accidentally watch the populist tripe of Lou Dobbs on CNN as he, no doubt, will take his turn at expressing outrage. Now if instead of spewing indignation, he actually took the trouble of locating a typical AIG executive who received a bonus and sat him or her down for a meaningful interview… of course I am quite willing to bet that this is not going to happen, not on CNN nor anywhere else… with the possible exception being BBC News.

That’s an ad that is running during local commercial breaks on CNN here in Ottawa, on Rogers Cable.

Too bad that as of yesterday, there is no A-News at Six. We live in interesting times…

OK, so after three decades of surpluses, we can certainly afford it, but it’s nevertheless an alarming sign of the times: Canada’s first trade deficit since, what was it, 1974 I believe. It is not a pretty thought.

While we were celebrating President Obama, the Bank of Canada made its move: the Canadian prime rate is now lower than ever, at 1%. The expectation is that the economy will not fare well in coming months.

Being the holder of a variable rate mortgage, I have no reason to complain. Still, it’s an unsettling development.

I just saw the documentary “I.O.U.S.A.” on CNN. Or, to be precise, I saw the last half hour of it, and then I went to the I.O.U.S.A Web site and viewed the “bite-sized” 30-minute version.

It’s alarming. I am not an American, and our country has so far maintained a modest budget surplus (this year, it may yet turn into a deficit, but perhaps not, as the days of the present government may be numbered) but I am still gravely concerned: a collapse of the U.S. economy or, more precisely, that of the U.S. dollar would make the Great Depression seem like child’s play in comparison.

No wonder many are expecting a near miracle from the incoming Obama administration. That is because it’s abundantly clear that “business as usual” means certain disaster. But what can Obama do? He may be exceptionally talented, but even so, miracles may be beyond his reach.

Watch out, you are being cheated.

Chances are you receive many offers like I do, from credit card companies offering incredibly low interest rates, no fine print, no questions asked, often not even a transaction fee. It makes sense to put these offers to good use, does it not? Or perhaps there is a subtle catch?

Indeed. And subtle it is, not very easy to explain. Let me try to use an example with numbers.

Suppose you have a VISA card and you spend $1,000 on it every month, but you’re like I am, and pay it off at the end of every month. So you don’t even care that the interest rate is high, say, 18.5%, since you never pay any interest (much to the regret of your friendly neighborhood credit card company.) But then comes this hard-to-ignore offer: you can pay off another debt at the low-low interest rate of just 2.99%!

So you do that, pay off a $10,000 debt using your VISA card, figuring that you’d do like before, and pay your $1,000 plus any accrued interest in order to keep your card in good standing. Meanwhile, you ignore the small print that says, in part, that “if you have low rate offers, which apply to a portion of your overall cash advance balance, then your payments are applied to these low rate offer balances first”. Yet this text is critical.

For here is what happens. At the end of your first month, you’ll be owing $11,024.58 to the credit card company: $10,000 was the loan amount, $1,000 is your monthly expenses, and $24.58 is the “low low rate” interest on the $10,000. So you send the credit card company a check for $1,024.58.

The next month, you find that you owe the company $11,036.37. Of this,$22.12 was interest on your low interest loan amount of $9,000 (!), while the rest is your present month’s spending of $1,000 along with high-rate interest at $14.25 on last month’s spending of $1,000. In subsequent months, things get worse: every time you send $1,000 to your credit card company, instead of being applied against your current month’s expenses, it is used to reduce the low-interest debt. In the sixth month, you’d be paying them $1,085.22: $1,000 is what you usually pay, last month’s spending that is, $11.94 is the interest on your preferred loan (now only $4,855.50), while $73.29 is interest on your accumulated high-interest balance of $5,144.50!

Whoa! On average, you will have paid interest at the rate of 6.66%, which is well over twice the advertised rate!

If your monthly spending is higher, things get even worse: at $1,500 a month, your effective interest rate will have increased to 8.53%. Not a very good deal, is it.

The only way to take advantage of a special offer of this kind is with a credit card on which you have no unpaid balance and which you are not using for any other purpose until the loan is repaid. Otherwise, you’ll be paying through your nose.

Here’s a little calculation with Microsoft Excel that demonstrates the six-month payment schedule:

| Preferred rate: | 2.99% | |||

| Regular rate: | 18.50% | |||

| Loan amount: | $10,000.00 | |||

| Monthly spending: | $1,000.00 | |||

| Low-interest balance |

Interest | High-interest balance |

Interest | Monthly payment |

| $10,000.00 | $24.58 | $1,000.00 | $0.00 | -$1,024.58 |

| $9,000.00 | $22.12 | $2,000.00 | $14.25 | -$1,036.37 |

| $7,985.75 | $19.63 | $3,014.25 | $28.69 | -$1,048.32 |

| $6,957.06 | $17.10 | $4,042.94 | $43.35 | -$1,060.45 |

| $5,913.71 | $14.54 | $5,086.29 | $58.21 | -$1,072.75 |

| $4,855.50 | $11.94 | $6,144.50 | $73.29 | -$1,085.22 |

| Effective rate: |

6.66%

|

|||

The other day, David Letterman had a segment called The Ten Most Hated Christmas Songs. They were well known Christmas tunes with twisted lyrics. All of them were funny, but two I found especially memorable. The first said,

“Joy to the world, George Bush is done.”

The second one was really creepy:

“It’s beginning to look a lot like Christmas,

“Nineteen-twenty-nine…”

Indeed.

I’m listening to Mitt Romney. He’s not the only one suggesting that the big problem with Detroit is that it is burdened by its unions: that excessive benefits like generous pension plans are the reason why Detroit cannot compete with others, and that the solution is a restructuring that helps the automakers get rid of these undue burdens.

I don’t want to sound like a grumpy socialist (which I am not, or at least I sure hope I am not) but is the rolling back of worker benefits really the right solution in this time of crisis? I am certainly not advocating an isolationist economic policy that protects an inefficient industry from foreign competition, but how about requiring that other automakers who either manufacture cars in, or export cars to, the United States, play by the same rules as the “big three”?

Either Romney is wrong, and the unions can take solace in the fact that a Democratic president with a large Democratic majority in both houses is about to be unaugurated. Or, Romney is right and Obama and the Democrats are about to make some colossal economic mistakes. Time will tell.